Duc Long Hoang

I haven't added a portfolio update in a long time 😁 I've been gathering more funds lately, and at the same time my favorite titles have been relatively depleted, so I've increased my positions and drastically increased my passive dividend income. I'm enjoying it! 😁🚀

Zobrazit další komentáře

Wonderful numbers this, how long did it take you to create a porfolio of that volume? :)

Zobrazit další komentáře

High-risk for me. The dividend has been stagnant for years, so unsafe for me.

Zobrazit další komentáře

Zobrazit další komentáře

Strong margins, cash amply covers all debt. EV/EBITDA 4.17. July 13 ex dividend date. Looks very good, did you find a catch?

Hey. Is there something like a tracker for your entire net worth? A lot of you here have asked about the Stock Events one that I use for stocks... that's great, but I'd like something to track my entire personal finances. Do you have anything? Currently my best bet is probably to do my excel and sheets in it. Stocks, Crypto, Cash, Physical Investments, etc. I've got quite a bit...

Read more

Zobrazit další komentáře

I personally track something similar on getquin, but I would not be completely satisfied with the look and functions.

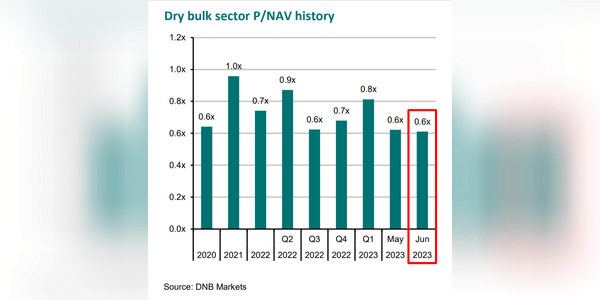

Someone posted here today about how the shipping sector doesn't strike him as unnecessarily subdued... so I guess that's it. I think that speaks volumes 😏 How do you think the shipping sector is doing?

Zobrazit další komentáře

I don't know where they are now, I don't move in that sector. But I do know that if they are doing well now, the cycle will soon reverse (I don't know when) and with that will come falling expectations for dividends, the main driver of these companies.

This is going to hurt 😂😂 I expect $100 in the fall after this overinflated bubble shows more disappointing results again. Your guesses?

Which tech/growth stock do you think is most likely to change strategy and start paying out a divi now? You guys keep leaning on me for being an old man and looking at this too much, so I'd be happy to take your advice. Sometimes you have to cross over 😜

Zobrazit další komentáře

Considering that the dividend is the company's last resort for what to do with the money, I wouldn't expect that from a technology/growth company. They often have many better ways to handle the money.

Zobrazit další komentáře

I'm going to repeat myself, but this was my best purchase last year (early February 2022). I'm even more pleased that it was my third largest position in my portfolio at the time. It's thrown me a wonderful appreciation on those dividends since then, and currently the position itself is even slightly in the black. I'll be holding for a while :)

I'm getting a bit fired up... pls throw me some tips on some interesting divi companies I can dig into tomorrow? Thanks!

Zobrazit další komentáře

I agree with Paul, I don't have to tell you because as you say the price is already high, but it will be similar to $KO, it's just that sugar is such a legal drug and not enough people realize the addiction and don't want to, so I wouldn't worry about any drops. 😁

And you're not afraid of Amazon and their entry into telco? :)