Regular investment is the key to long-term growth and financial stability. Historical data suggests that a systematic approach to investing brings benefits. Investing on a monthly or regular basis allows to take advantage of the averaging effect of the purchase price and reduce the impact of short-term market fluctuations.

Regular investing has the potential to avoid speculative market timing, which is often difficult and risky. Relying on average market appreciation over the long term provides investors with greater flexibility and reduces the negative impact of fluctuations on their overall performance.

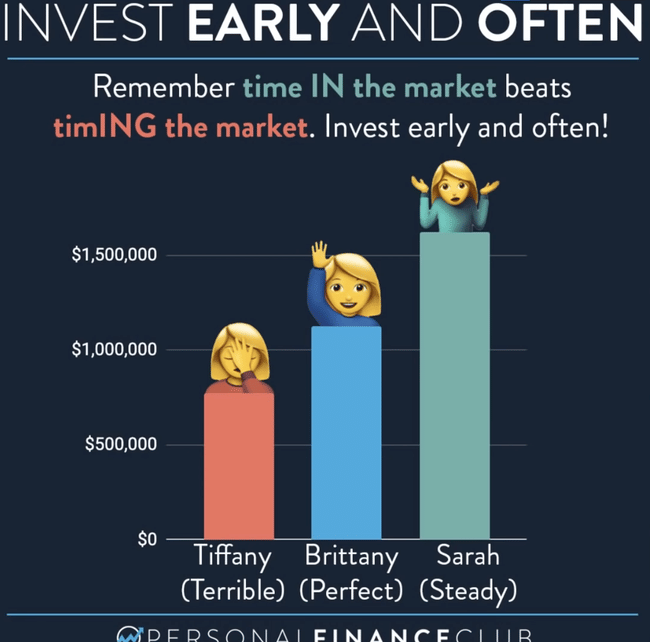

Let's take the example of 3 investors operating with the same $99,000 in capital, but investing it at different times each time.

TIFFANY - Unfortunately, they hit days when the SNP 500 stock index was just peaking and the markets always fell after that day.

BRITTANY - She hit the best days in the markets and always bought on the very day the markets turned around and rose after the crash. Unrealistic - but for an example.

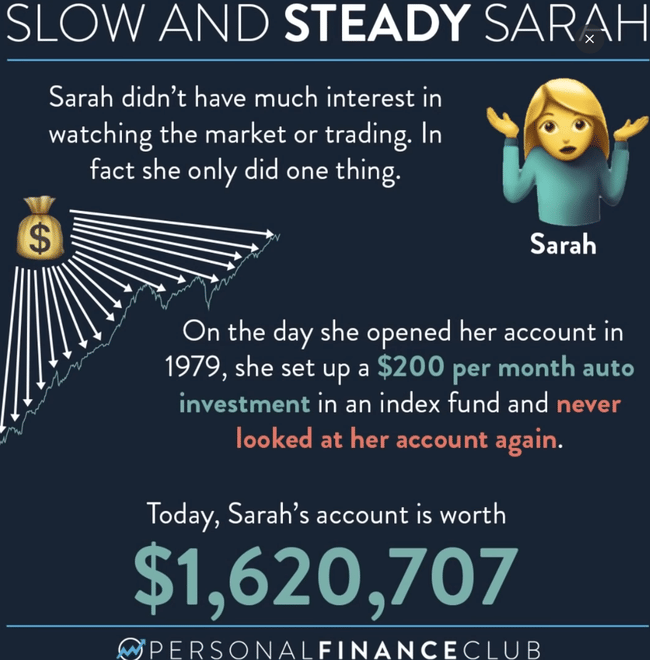

SARAH - Regularly invests whatever happens in the markets, always the same amount.

And the result? Over a 40 year horizon, the investors have all made money.

Tiffany, with her terrible timing, made money. Thanks to the length of time she's been invested in the market.

Brittany, with her perfect (and unrealistic) timing, made a lot more.

Sarah, with her regular investing, made the most money because she didn't have to wait for the days when it was the right time to invest and was invested in the market the whole time. TIME IN THE MARKET BEATS TIMING THE MARKET!

What about you? Do you wait or are you a boring and regular investor who wins in the long run anyway? :P

PS: Valid for investing in ETFs, individual stocks obviously work on a slightly different basis. :)

I buy ETFs and dividend stocks regularly every month. When there is a dip in a stock and it gets to a nice price, I buy that too.

Regularly + overbought when there's a dip and now I'm about to diversify a bit, so I'm just at the where stage :D

My opinion is that time in the market is important, regularity is not so important. Statistics say that 75% of the time it is better to invest everything we have now than to split the capital into parts and do DCA. Of course, DCA makes sense when one has income coming in every month.

I invest regularly and for the long term. I have occasional shortfalls because I need the money for other things.

I have seen several such comparisons, but the result is always the same. Investing regularly and for the long term is the way to success.

I invest regularly because there are always pieces on the market that are undervalued. However, when the market is down, I try to invest more money than I normally would.