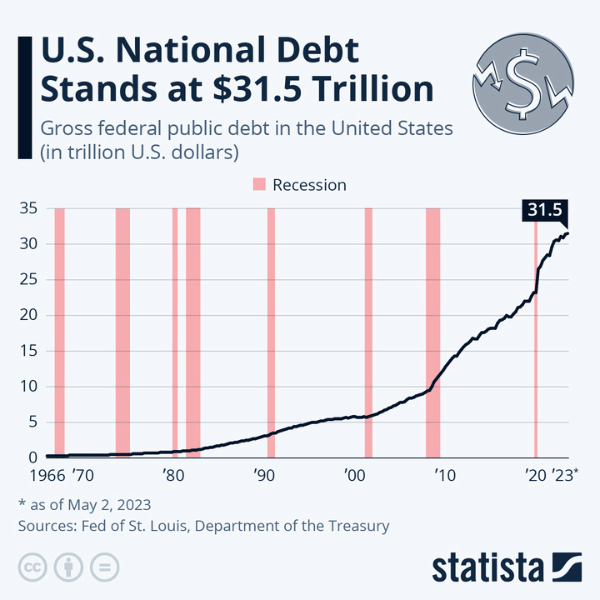

Over the past 23 years, the US government debt has increased 460% to a record $31 trillion, a significant problem for the stock markets, the economy, ordinary people and ultimately the world. What could happen?

Since 2000, U.S. debt has grown from $5.6 trillion to over $31.38 trillion, a staggering 460% increase, while the threat of letting the nation declare bankruptcy has become a frequent theme.

Threats in Congress to refuse to raise the debt ceiling are now back on the table. We can see this topic being broached more and more in recent weeks. And although this scenario has been played out several times in US history, the ceiling has always been raised in the end. This time it may be different, coming from experts who are very skeptical and are already addressing the possible implications.

Despite several serious challenges, the US has never defaulted on its debt obligations. Today, however, the tug-of-war is playing out again as Republican Speaker of the House of Representatives Kevin McCarthy refused to pass what Democratic President Joe Biden calls a "clean" debt ceiling bill.

What is the debt ceiling?

The debt ceiling is a legal limit on the total amount of debt the federal government can borrow to finance its spending. It's not even a very old part of American history: it was enacted in a different economic era, in 1917, when Congress ironically tried to streamline the process of raising funds along with the entry into World War I.

After reaching the latest debt limit of $31.4 trillion in January, Treasury Secretary Janet Yellen was forced to use "extraordinary measures" to keep the government running amid a stalemate in Washington. She has repeatedly warned that the deadline for raising the debt ceiling, otherwise known as X-date, is coming as early as June 1. Yellen believes this will cause an outright "economic and financial collapse" as the government would be forced to default on its national debt claims, as well as payments to Social Security recipients and Medicare providers.

What could happen?

So how could the failure to raise the debt ceiling and default on the national debt hurt markets and people?

1. Higher interest rates

The economy has been hit with higher interest rates for several months as the Federal Reserve has stepped up its campaign to reduce inflation. Many financial experts have said that a recession is likely this year. Failure to raise the debt ceiling would make a recession an almost immediate event.

So interest rates on mortgages, car loans and credit cards have already risen, but a default would send them even higher - not to mention the cost of borrowing for businesses. And even if the debt were resolved after default, rates would not fall back to where they were before.

2. Late Social Security payments

No one knows exactly how the government would respond to an unprecedented default on its debt, but the most immediate way the U.S. government could redirect funds to its debt obligations, forgoing payments to tens of millions of Social Security recipients in the process.

3. Job losses and market turmoil

White House economists recently estimated that as many as 8 million people could lose their jobs during a long-term default. It would also almost certainly lead to a recession that would affect all Americans in some way, as an actual default would roil global financial markets and create chaos.

A default could putthe country in a situation similar to a global financial crisis, according to a report by Moody's. This could lead to a $12 trillion loss of household wealth, with stocks potentially falling (according to multiple expert estimates) by 10-50% (here it will depend on how the whole situation develops).

4. The impact on the whole world

The crisis of confidence would likely spread to other countries and regions, including emerging markets. Because of the interconnectedness of global financial markets, it would not be possible to isolate the crisis to the US alone. Emerging economies are dependent on capital and trade with Western countries, so a downturn on Wall Street would have repercussions elsewhere. Investors around the world would begin to question the credibility of governments and question their debt obligations.

5. The dollar would weaken as confidence in the US would fall

If the world doubted the ability of the US to repay its debts, demand for US government bonds and dollars would fall. This could weaken the dollar, increase inflation in the US and exacerbate the problems of the US economy. While a weaker dollar would make US exports more competitive, it would also make imports more expensive, as well as debt repayments in foreign currencies. If the crisis were to trigger a broader economic downturn, exports would fall anyway. Moreover, some of the US debt is owned by foreign investors, who would lose money if the dollar and bonds were sold off. This would further damage US relations with the rest of the world.

President Biden said today: "The Republican position on the debt ceiling is unacceptable."

"Now is the time for the other side to move from their extreme positions," President Biden said during a press conference before his departure from Hiroshima, where he spent the last few days meeting with world leaders at the G7 leaders' summit.

Talks stalled on spending and revenue

A key sticking point among many interlocutors is the level of spending.

The GOP proposal approved in April would reduce discretionary spending to 2022 levels and then impose a 1% cap on future increases.

McCarthy said Friday that if Democrats "think we're going to spend more money next year than we did this year, that's not right, and it's not going to happen."

https://twitter.com/SpeakerMcCarthy/status/1660033659405991936

Conclusion

Overall, a U.S. debt default would cause geopolitical and economic chaos that would reverberate around the world. In today's globalized economy, no country is an isolated island anymore, not even an economy as large as the United States. The short-term effects would be catastrophic and, in the long term, it would seriously undermine US dominance in the world.

Please note that this is not financial advice.

At some point, that stop in the debt buildup has to come. The question is whether it will be sometime in the next few months, or whether they will continue to run up the debt and it will come later, or whether they will figure out how to get out of it without pain, but I can't think of how.

I wouldn't worry about it in this situation. Weakening of the US, distrust of the dollar, etc. would play into the hands of "the other guy" more than ever in this situation. And the Republicans don't want that either. On the other hand, they'll probably get some changes in Biden's policy for it, like recklessly throwing money at Ukraine and similar profligacy.

Nice article, we can only wait 😃

Nice article. Anyway, it's just kind of a stalemate. Sometimes it's just gotta happen. It's scary how many times they've run up debt and done nothing about it, just no one has leverage over them, it's a superpower. On the other hand, nobody wants it and everybody wants them to start the printing presses again, but what's that going to solve? Nothing at all, it'll just push the problem back a few years.

I'm getting more and more worried, hopefully they'll sort it out... And then they'll finally start fighting the debt, which is probably not an option. 😁

The likelihood of this happening is almost zero.

thanks for the article this is a really big deal so I wonder how they will handle it :/