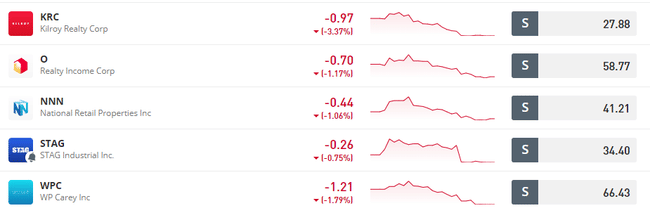

REITs are going down after all. Slowly but surely.

For example, the popular $WPC hit its annual low today. It was last at this price in January 2021.

Buying one? I'm waiting - I think there's still decent room to fall.

REITs are going down after all. Slowly but surely.

For example, the popular $WPC hit its annual low today. It was last at this price in January 2021.

Buying one? I'm waiting - I think there's still decent room to fall.

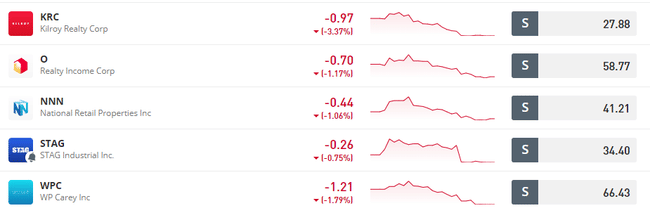

I've been adding more recently, but only a little to dilute it. Now I'm waiting too because as you say as long as rates keep going up, it's just bad for the reit industry there's probably still room for a fall. Otherwise $O is such a classic I have and it will definitely be the biggest position still in that sector for me. And then $WPC I also have and I'll be adding there too, but I'm watching for now.

I'm just watching for now, but I'm thinking of including $O in my portfolio since it's currently at a pretty nice price point.

I added $O. But I don't like the situation in the US real estate market at all, commercial property occupancy has been falling over the year, as for conventional houses, prices are falling there, but the statistics show that people with mortgages have been getting progressively worse off over the last few months.

And as a bit of trivia, Pacific Investment Management recently defaulted on $1.7 billion of office mortgages in major US cities. Everyone has to make up their own mind about the state of the real estate market, but I don't see it very optimistic. I'm going DCA though, so I'm ready for anything.

Now I am not buying and just watching how the real estate market will be.