Stock Market Calendar (July 17 - July 21, 2023)

Earnings season is upon us, with quarterly economic numbers coming out in the third week of the holiday season, including $TSLA, $BAC, $NFLX and $AXP in the US. Investors will also be evaluating macro data and, on the old continent, the new economic forecast from the European Commission.

Outlook

"The coming week will belong to earnings season, which will be in full swing on both sides of the Atlantic. If it progresses in a similar vein to its start, it should boost interest in risk assets. Our expectations are in favour of a better outcome, which is why we are slightly positive for next week," wrote Milan Vaníček.

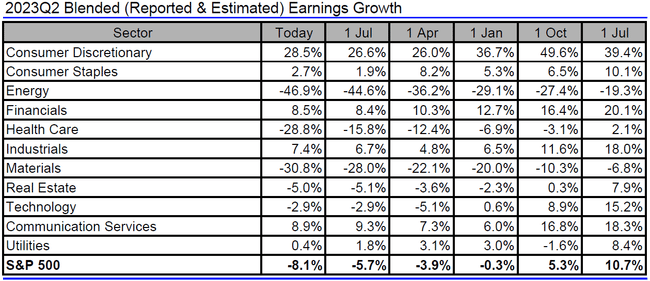

Analysts polled by Refinitiv currently expect companies in the S&P 500 to report an 8.1% decline in earnings for the second quarter on a 0.9% drop in revenue. Year-over-year higher profits are expected to be reported by companies in the cyclical consumer goods sector, while the decline in profits is expected to be mainly reported by energy and basic materials companies.

Macroeconomic Calendar

Overnight on Monday, China will release reports on GDP, industrial production and retail sales, and in the United States, investors will assess the New York Fed's Empire State index of industrial activity in the afternoon.

Tuesday in the United States will be devoted to retail sales, industrial production, business inventories and the NAHB's residential real estate market index. Canada will send inflation data to the market and the European Commission will release an updated economic forecast.

On Wednesday morning, investors will focus on UK inflation and in the morning Eurostat will release inflation statistics for the Eurozone. In the United States, building permits and construction starts will be released in the afternoon.

On Thursday night, Japan will present its trade balance result, the Chinese central bank will discuss interest rate settings and Australia will present labour market data. In the morning, investors will focus on German manufacturing inflation and the eurozone current account, and in the afternoon, the United States will add its regular weekly jobless claims report as well as the Philadelphia Fed's industrial activity index or older home sales data and the European Commission's consumer confidence for the eurozone.

Friday morning will offer British retail sales and Canada will present the same statistics in the afternoon.

Great thanks for the recap. $BAC had pretty solid results in the end and I'm looking forward to seeing the results of $ASML, $TSLA and $NFLX today.

I don't know what to expect with the $BAC, whether to buy ahead or wait for the results.

Nice summary, thanks. I'm curious, for example, about the $BAC I have in my portfolio. The $JPM for example didn't have it so bad, it rose after the results but still ended up closing in a loss that day.