Feed

Investors, is there a stock you've liked this year that you've bought often and has become your favorite?

I have become very fond of $ASML, $CVS and $O this year. I see potential in all three companies and think there is quite a bit of room for growth in the stock. I've bought the aforementioned stocks quite frequently this year and they already make up a large part of my...

Read more

Zobrazit další komentáře

Zobrazit další komentáře

Zobrazit další komentáře

A few years back I had a little something there, but I sold it for a loss because it looked like a value trap. Canon didn't make much money on photo equipment, the lithographic equipment was a step behind ASML and could only compete with Nikon. Most of their income comes from printers and that may be a declining business over time (I see it mentioned in almost every HPQ analysis).

What I understand so far is that their machine is based on a completely different principle than the EUV from ASMl and the process is more time consuming, so the efficiency/costs are not fully ideal and especially it is not yet proven in series production. If it turns out that it really can do 4nm technology in sufficient quality and price, it may change the balance of power in ASML's monopoly position, but I think we are still far from that.

Anyway, I think that even if the lithography does take off, it won't be an advantage for them over ASML in terms of being able to supply China with the technology to make advanced semiconductors. They will get the same restrictions from the US as anyone else.

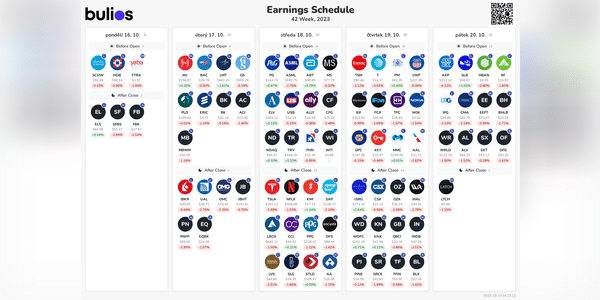

Investors, which company's results surprised you the most this week? Did you buy or sell shares of any companies before or after the results?

I was pleased with the results of $BAC and a little surprised by the results of $ASML. I was still buying $BAC on Monday before the results and buying $ASML on Wednesday after the results at a discount.

Shares of $ASML are up more than 10% this year, but the share price is still a great buy for me. Yesterday ASML reported its results, which I view quite positively, but the stock was down about 5% after the results and I did a little overbought.

Do you have $ASML stock in your portfolio and are you overbought at the current price?

Zobrazit další komentáře

You may have caught that Canon is launching an alternative product that is capable of producing 5nm cycles. It's nicely done here, so someone might be interested in https://youtu.be/8UdNB3ZY4Ks?feature=shared

Investors, what stocks have you been most interested in this year and which companies have you bought the most shares of this year?

I've been very interested in $NVDA stock this year, as it's been growing incredibly fast this year, and I've bought the most shares of $ASML and $CVS so far this year.

Zobrazit další komentáře

You're already recapping the year like this? Wait at least 2 more months, only autumn will be a ride! :-D

I have decided to buy some $ASML stock this month. ASML primarily makes chip making machines. More and more chips will be needed, which means the company will be very successful in the future. Personally, I see a lot of potential here and the company has very nice fundamentals and I will be buying some of the stock even though the stock is not exactly cheap.

Do you have shares...

Read more

I've mentioned ASML stock here a couple of times, a company I like a lot, and until a few weeks ago I wasn't sure whether I would buy this stock or not. Last week, despite the stock being high, I bought a portion of $ASML stock. I see great potential here and the company is expecting high revenue growth and overall expects great growth going forward.

I don't often buy stocks...

Read more

Investors, what stocks and ETFs have you bought or sold recently and what stocks are you looking to buy or sell?

I like every month bought $SPY, $MO and $CVSandthis week I still bought part of $ASML stock. I'm not selling anything yet but next week I plan to sell off part of $MMM stock and otherwise hoard cash for any dips.

Since someone mentioned $ASML - do you think there is a similarly important but unknown company in the world? I think it could be BASF. What do you think?

BASF is one of the largest chemical companies in the world, specialising in the production of chemical products for a wide range of industries. The company produces, for example, polymers, pesticides, dyes, pharmaceuticals,...

Read more

Tomorrow, many interesting and well-known companies will report their results, but I will be most interested in the results of the Dutch company $ASML. This company produces advanced equipment for chip manufacturing. ASML is very financially stable. In addition, I would like to buy shares of a European company already. However, the stock is really high at the moment.

...Read more

Zobrazit další komentáře

Before someone writes again that it's very expensive, I hope he doesn't plan to buy MSFT, AAPL, KO, PEP and similar evergreens in the near future;)

Take a look at your portfolio and see how many stocks you hold have a PEG ratio lower than 1.68

ASML has been growing 25% for the last 5 years and the forecast for the next 5 years is the same, except that analysts know exactly what earnings they will have 2 years in advance because that is how long they wait for orders to clear.

btw the fact that it is worth 800usd today solves the fractional shares, who expects this company to drop to a P/E of 25 so will wait another 5 years;)

Kb, coin, lvmh