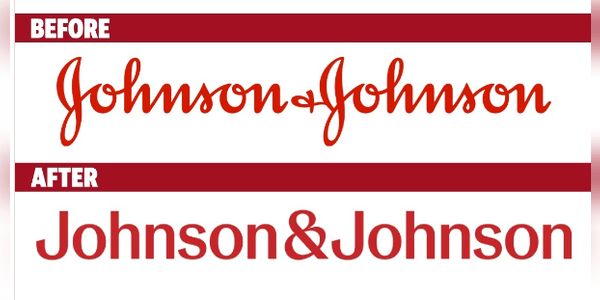

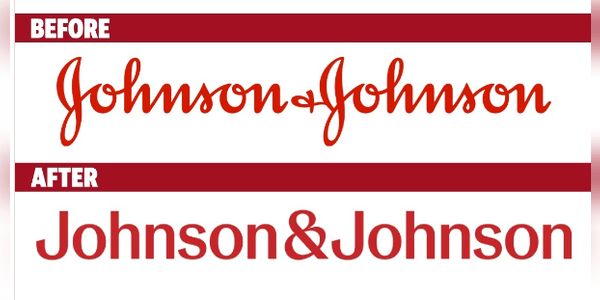

Johnson & Johnson changes its logo after 130 years.

Did you like the previous logo better, or do you like the new one better?

Johnson & Johnson changes its logo after 130 years.

Did you like the previous logo better, or do you like the new one better?

Investors, which broker do you use and why?

I use XTB and it suits me very well. I use XTB broker because it offers a lot of cool things like a lot of educational material, whether on social media or on YouTube where I learn new and useful information all the time. I also like the platform which is very clear. As a last thing I would like to mention fractional shares, as XTB has...

Read more

Investors, what stocks have you been most interested in recently and why?

I've been interested in $AMZN, $NKE and $CVX stocks lately. I see some potential in all three stocks, and $NKE and $CVX are at a nice price recently. Plus, all three stocks are from a completely different sector. Tech. stocks are already in my portfolio, but NKE and CVX could diversify my portfolio nicely.

Medtronic develops and manufactures medical technologies and devices that help patients with a variety of health problems. For example, the company manufactures various automated robots for surgery. I see quite a lot of potential here and the current share price is not bad at all. Buying up to $85 still looks fine to me, which is confirmed by the indicator here on Bulios. The...

Read more

We have seen US bank stocks fall quite a bit this year. For example, $BAC stock is down more than 13% this year and $C stock is down more than 9%. However, over the past month, bank stocks have been falling very quickly and noticeably ( see image below ). Otherwise, I have been regularly buying $BAC stock lately as it is currently at a great price and I am still thinking about...

Read more

Banks are too conservative, boring and slow for me... I wouldn't go there :)

Shares of $PFE are down more than 30% this year. The current price is very nice and I would say the stock is even undervalued. For me, the share price is perfectly fine for a buy under $40 and the indicator here on Bulios confirms it for me. I will be buying shares of this company this week and will be looking forward to the dividend :D.

Investors, which stock in your portfolio is the most profitable this year and how much % is it up ?

In my portfolio, $GOOGL stock is the most in profit this year by 39%. I would very much like to see $NVDA stock in my portfolio, however somehow I have not focused on this company and unfortunately I have not bought the stock :D.

Investors, what stock have you held, do you hold, or plan to hold the longest in your portfolio?

I hold $AAPL stock the longest in my portfolio and plan to hold it for several more years to decades. This company is awesome and the business is unreal. Shares of $AAPL have fallen a few % in the last few days and the company has lost roughly $200 billion of its market...

Read more

Buying ETFs is like putting on clean socks in the morning... classic :) I am accumulating and will gradually pour cash into the market and into individual titles.

Novo Nordisk A/S is a Danish company that recently introduced a cure for obesity. Shares of $NVO are up more than 20% in the past month and more than 40% this year. For me, the company is going in a good direction and the business is also great, as obesity is really affecting a lot of people at the moment and if the development of this drug goes as well in the future as it has...

Read more

The company is doing very well indeed. It's healthy and making solid amounts of money. The chart is logically consistent with that. But now I think it's way up and even though there's no major tooth on the chart, I'm not going to go for it.

I Despite the fact that $AMZN stock is currently pretty high I am thinking about including $AMZN stock in my portfolio. According to the Bulios indicator, the stock is overvalued by over 30%, but in the long run I wouldn't be afraid to buy even at the current price. I would want to hold Amazon stock for the long term and if the share price gets below $120, I would already be...

Read more

I also like the company and have it in my portfolio. As you write with and others here agree, as per the log term why not, surely in maybe 10 years the price will be a lot different, I expect upside. 😊 As for how much it is overvalued, to some extent it is individual. It's great to know a fair price, or be able to calculate it, but it depends on what parameters you put in, although most are the same from spreadsheets, there are a few that are just yours so it can vary. I personally don't buy yet, my purchase is something around $100 and I figure I'm not out of the woods yet so if we got lower, like the $120 you mention, I'd be overbuying. 😊

I've been buying into REITs quite a bit in recent months. I have $O stock in my portfolio, which I try to buy below $60. More recently, I've added $VICI stock to my portfolio, which I've been buying below $30. It seems to me that REITs have been getting hammered quite a bit lately, so I've been overbought regularly and looking forward to the dividend coming :D.

What REITs do you...

Read more

Investors, what stocks have you been most interested in this year and which companies have you bought the most shares of this year?

I've been very interested in $NVDA stock this year, as it's been growing incredibly fast this year, and I've bought the most shares of $ASML and $CVS so far this year.

You're already recapping the year like this? Wait at least 2 more months, only autumn will be a ride! :-D

I wonder what is the reason for that, because the original one is nicer :D