Feed

Zobrazit další komentáře

Zobrazit další komentáře

The results of the "tobacco companies" were pretty scattered this week and so were their stock movements :) Some up, some down. $BTI was up nearly 7% yesterday, but the premarket isn't favoring the company and the stock is down 1.7%. We'll see how this plays out. It's a tough business at the moment. Cigarette sales are down.

Zobrazit další komentáře

I don't have anything planned yet, I also wish you all the best for the new year!

Tobacco companies were shaken up today

As I've noted here, for many of us investors, these companies are popular mainly because of their attractive dividend. In that regard, it is mentioned here often. This post will mainly focus on British American Tobacco $BTI $BATS.L, but as there has been more talk lately about hitting the ranks of smokers and trying to keep them healthy,...

Read more

Zobrazit další komentáře

At my age it would probably not be nice if I wrote that I am a smoker, but of course I am a non-smoker and I am sure I will be one until I die. From a moral point of view it's probably not fine, but I like the tobacco companies and even more the dividends they send me :D. Despite some problems I trust the companies and I believe they will be with us for a long time. I bought BTI in the downturn and I watched that MO wasn't at a bad price either, so I bought BTI along with MO :D.

Zobrazit další komentáře

Moneta, KB, Vitesse Energy, Mercedes-Benz, Verizon, Société Generale, PKN Orlen ... my top two

Shares of $BTI are down more than 20% this year and I am currently buying $BTI stock on a regular monthly basis as the current price is a great buy. For me, this is a great company with a great business and pays a very nice dividend.

Do you have shares of $BTI in your portfolio and are you overbought at the current price?

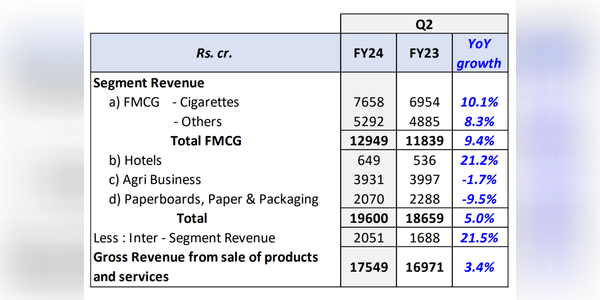

ITC Ltd reported results today. We are talking about an Indian company in which $BATS.L/$BTI has about 30% stake.

Q2 2024

The interesting numbers are from the fast moving consumer goods segment, which includes cigarettes. Cigarette sales are up 10.1% year-over-year. A different trend from the European one.

Read more

Zobrazit další komentáře

I'm thinking of listing a PUT on $NIO, and probably some CALL spreads to go with it.

One of the top two of the top 10% has $BTI. Aside from the fact that I'm completely out of touch with the product, I'm wondering about the future of the tobacco industry. The ever increasing tax in some countries has driven the prices up so much that some customers have just given up. So is the future of tobacco companies in electronic cigarettes or something else entirely?

Zobrazit další komentáře

I think the sector is very stable and companies have found that normal cigarettes are not working so well so they are switching to other products such as electric cigarettes, which young people are buying, and I think tobacco companies will continue to do well. Otherwise, I have $BTI stock in my portfolio and the dividend is great :D

I plan to buy more $BTI stock next week. Shares of $BTI are currently very undervalued and the company pays a dividend of 10%, which is very respectable. I also plan to buy more shares of $MO as the stock is at a nice price.

Which tobacco company's stock do you have in your portfolio and at what price are you buying?

Those classic tobacco products, I think, are not and will not be as popular anymore, but companies are moving on to making different and "better" products. I have plenty in BTI and MO, but I don't want to overbuy anymore and probably won't for a while.