Feed

Zobrazit další komentáře

Zobrazit další komentáře

The companies you listed have been on sale for a long time. I guess I'm fine with this situation, I'll just keep shopping cheap. I bought another $PFE today. Thanks for the recap!

What sector are you primarily focused on and what sector do you see the most potential in???

My main focus lately has been on the healthcare sector, as I see huge potential there. I think the healthcare sector is still moving forward and will grow even more in the future.

When I look at how many people have some health problems and medicine is needed more and more, or how many...

Read more

Zobrazit další komentáře

I understand the tobacco industry the most. Next would probably be the automotive industry, where I currently have only one representative. I also have quite a bit invested in the healthcare sector, although I don't move much in it. Then maybe 1 piece of each for diversification, my portfolio is constantly changing.

Charlie Munger and his view of healthcare in the US.

Charlie, a friend, partner of Warren, has recently been vocal about his concerns about US healthcare, literally stating that it is a system that prolongs death to make more money and comparing patients to African carcasses. 🤔

Read more

It often writes about dividend stocks.

I would like to know what dividend stocks you have in your portfolio and if you would like to add any dividend stocks to your portfolio.

I have $CVS, $MMM and quite a few $MO stocks in my portfolio. For now, I plan to continue to add to these stocks. However, I would like to include a few more dividend stocks like $PEP, $PG, or maybe $T in...

Read more

Health insurer stock prices fell today after UnitedHealth($UNH) said the number of surgeries for adults age 65 and older increased more than expected over the past two months.

Health insurers have benefited from delaying non-urgent surgeries due to the COVID-19 pandemic and staffing shortages at hospitals.

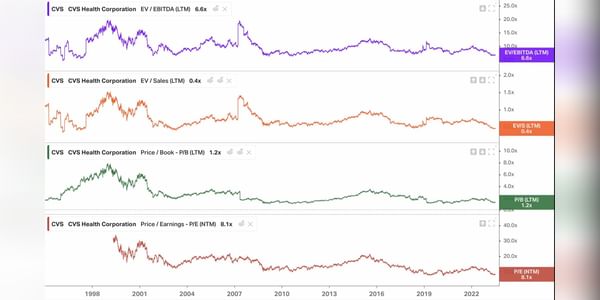

For example, the popular $CVS here fell less than 6%. An opportunity to...

Read more

Hey, investors.

I've been interested in the healthcare sector quite a bit lately. Because I see a lot of potential in it.

Medicine in general has made huge strides recently, whether it's the production of weight loss drugs, for example, or the production of robots for surgery.

I have $JNJ and $CVS in my portfolio so far, but I'm still thinking about $MDT, which is the company that...

Read more

Zobrazit další komentáře

Zobrazit další komentáře

Healthcare is not represented at all... I honestly don't even know what to look for in it, I don't know any companies and I don't even have anyone around to ask in that regard :) It's a bit of a blackbox for me.

After today's $PFE results, investors are likely to be tough on even competitor $CVS, which will report its results tomorrow before the market opens. So I expect a pullback, which I will use to increase my position. Anything around $70 is a nice price in my opinion. In fact, I don't think $CVS should come up with surprisingly good results.

Zobrazit další komentáře

I don't follow pharmaceutical companies much. Occasionally you can find nice ones that come up with a discovery (drug, method). Unfortunately, I've been burned by such startups. I don't know $CVS but I might look into a pharmaceutical company.

I own one too and true, now that I read it, it's a really popular stock. Well, let's hope it's not just another "popular" flop. Nah, I'll add to the opinions that yes, if nothing goes wrong, it will definitely be elsewhere, higher, in those 2 years. 😊