Fair Price

Profile

Feed

Investors, what is your most profitable position in your portfolio and what % is it?

Last week I asked you what your most profitable position is, so today I'm asking you and you can tell me what your most profitable position is. In my portfolio, the most profitable so far is $AAPL over 40% and right after that $GOOGL slightly over 30%.

Zobrazit další komentáře

Zobrazit další komentáře

Zobrazit další komentáře

I only eat DCA, so to speak, as part of portfolio dilution/rebalancing. Alternatively, I also break up my purchases into multiple parts. But that I regularly put the same amount in the same title, no.

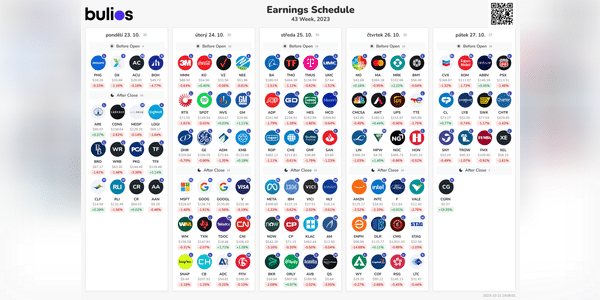

Investors, which companies' results will you be watching next week?

I'm very interested in the results of $MMM, $KO, $MSFT, $GOOGL $WM, $META or maybe $AMZN. Next week will be very interesting as far as company results are concerned and I'm very interested and looking forward to the results of several companies.

Zobrazit další komentáře

This week is going to be big, there is a lot of it, but most of all I am waiting for info around $ENPH where it has already fallen quite a lot and where I am quite invested, so I wonder what the next drop will be, which I rather expect, but hopefully not so big.

Zobrazit další komentáře

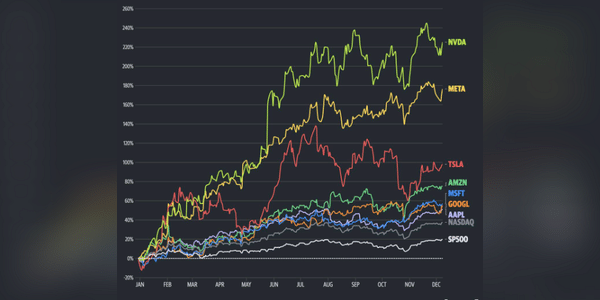

Investors, which stock in your portfolio is the most profitable this year and how much % is it up ?

In my portfolio, $GOOGL stock is the most in profit this year by 39%. I would very much like to see $NVDA stock in my portfolio, however somehow I have not focused on this company and unfortunately I have not bought the stock :D.

Have a good weekend, investors. How do you feel about the dependence of tech giants like $MSFT $GOOGL $AMZN on artificial intelligence chips from $NVDA?

These tech giants are progressing in developing their own chips for their data centers with AI deployment. An important example is $MSFT 's recent investment in d-Matrix, a company that designs optimized chips to power...

Read more

Zobrazit další komentáře

It's very possible that the tech companies will make the chips themselves and won't be so dependent on Nvidia.

ARM HOLDINGS is gearing up for a spectacular initial public offering to test the market's interest in a major technology company. But its target valuation suggests it is resigned to not being the next Nvidia.

According to The Wall Street Journal, citing people familiar with the matter, British chipmaker Arm is seeking a valuation for its initial share offering on the Nasdaq...

Read more

Zobrazit další komentáře

I was very interested in this company, but somehow I forgot about it, so thank you for reminding me. I'll have to take a quick look at the company and I'll definitely be following the IPO at least a little :)

Arm has signed agreements with large technology firms for IPOs worth $50 billion to $55 billion.

Apple Inc $AAPL, Nvidia Corp $NVDA, Alphabet Inc $GOOGL and Advanced Micro Devices Inc $AMD have agreed to invest in the chip designer's initial public offering (IPO), according to sources familiar with the matter.

Intel Corp $INTC, Samsung Electronics Co Ltd, Cadence Design Systems...

Read more

Also for me so far unfortunately high, I would see the purchase from 130$