Feed

Hey, investors.

I recently wrote a status here about fundamental analysis, which also includes management.

For me, management is very important in fundamental analysis. Because management decides what will happen to the company or, for example, what dividend will be paid and they can also partly influence the development of the share price by their actions.

It is not usually the...

Read more

Zobrazit další komentáře

Management is quite important to me, I like to see competent people with some history. That's why I'm not afraid of Tesla. I have a lot of confidence in Musk, no matter how controversial he is.

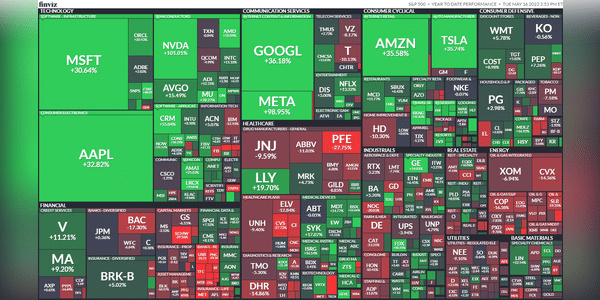

$TSLA One of the most loved and hated stocks among investors. Just a controversial piece. One group loves Musk and the other hates him. :D Are there any early investors who have made good money on Tesla or, conversely, lost money? Plus what do you think of the current price? The $TSLA looks like pretty good money to me at the moment.

Zobrazit další komentáře

I've been meaning to hop on for years... and even though I try not to time the market, I'm not getting it right here and I'm still waiting for the "right" moment... which of course I haven't found yet :-D

Tesla still seems quite overvalued to me... I could see the price somewhere around $100-120 per share... then it would probably be the "right" time for me :)

Zobrazit další komentáře

I think he did the right thing, there won't be so much controversy around Twitter now and he might be more focused on Tesla, unless he buys another company : ).

Zobrazit další komentáře

To all who own TSLA shares I recommend about 60min interview he recently did for CNBC, here I give only the part that I think is essential for shareholders https://www.cnbc.com/video/2023/05/16/tesla-ceo-elon-musk-ill-say-what-i-want-to-say-and-we-lose-money-so-be-it.html.

Musk, in my opinion, has a serious messiah complex, where he can't help but trumpet everything that goes through his complex brain to the world, even at the cost of hurting the companies he runs. Unfortunately, at that moment he is not thinking at all about his shareholders, who own the company he put on the stock exchange.

Zobrazit další komentáře

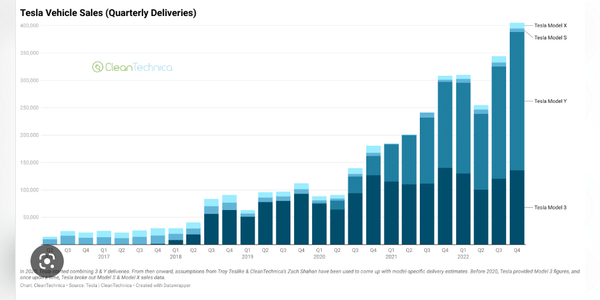

The bigotry at Tesla is insane, normal arguments are not enough here. But as an investor you might know that there were many such to the moon and where are they today? Nowhere... Nothing grows indefinitely, I deliberately did some digging and looked at such then top,top,top companies of the past and whether they still exist. Here's a few examples (I'm not comparing technologies, it's just an example that every company no matter how revolutionary will hit a wall at some point).

-Pan American World Airways (Pan Am) - in the 1930's the dominant airline, the first to fly across oceans and a symbol of luxury and technological advancement. But it folded in 1991 due to financial problems and competition from other airlines.

-East India Company - a British company founded in the 1600s that effectively ruled India and dominated world trade. However, it lost its monopoly in the mid-19th century and was liquidated in 1874.

-Sears Roebuck - American retail chain that revolutionized shopping with its catalogs in the late 19th century. In the mid-20th century it was the largest retailer in the world, but in recent decades it has fallen into decline and its fame has waned.

-Smith Corona - the dominant manufacturer of typewriters, invented in 1867 by Christopher Latham Sholes. But with the emergence of personal computers in the 1970s, demand for typewriters declined and Smith Corona lost its leading position. In 1995, it discontinued typewriter production.

I've made the arguments enough in the past, hence these examples, it's only a matter of time before the hype dies down and people realize that Tesla is just an overvalued company that will be replaced sooner or later anyway. But for EVs and Tesla that bump may come much sooner, maybe with the advent of hydrogen and alternative fuel cars.

I would add that they may gain a significant advantage if the collaboration with QS succeeds, but I doubt that it would primarily benefit VW. I think and hope that the effect will go to Porsche and when QS meets its obligations to VW there will be car companies that will make better use of the potential of the solid state. WV is an extremely bureaucratic and union bound company even by EU standards.