Monday Dayton

The job market showed us results and helped us end the week in growth. 🚀

So friends, for once, good news too. The latest employment data is back in the US and it is slowly painting the picture all investors want to see and that is that the job market is cooling and so for the Fed this may mean no more hikes.

Only 150,000 jobs were added in October, falling short of expectations...

Read more

Zobrazit další komentáře

Great news for the job market! 🙌 It's interesting to see how this impacts the Fed's decisions on rate hikes. The recent job growth moderation might indeed influence their stance. While the market is responding positively, I agree that some corrections could be on the horizon.

https://www.trippybug.com/best-places-to-visit-in-nandi-hills/

We have big news today and generally it's going to be pretty busy again. In the meantime, I'm wondering, what about you and the housing market?

About two months ago Paul posted info here regarding $BRK-B' s purchases and albeit smaller amounts, but the inclusion of $LEN and $DHI in their portfolio. These two companies are in the US building, building and selling new homes + $LEN...

Read more

US GDP grew at an annual rate of 4.9% in the third quarter, better than expected.

The U.S. economy notched a remarkable achievement in the third quarter this year, with growth exceeding the expectations of many economists and analysts. Gross domestic product (GDP), a measure of all goods and services produced in the U.S., grew faster than many had expected. This development...

Read more

Zobrazit další komentáře

That's pretty positive news for the US, theoretically it could have a positive impact on the market as well, but after what Google has dropped in the last 5 days...it's hard to say

Investors, let's break up this earnings week, which has been red so far in terms of declines, with a summary of central bankers' statements as we approach that Fed meeting. 😊

We all know and expect a pause now and interest rates to stay where they are. So I won't elaborate any more, just this time I'll add the statements in question that I found on YahooFinance. The markets are...

Read more

Zobrazit další komentáře

I'm also curious what the Fed will do, but I'm especially interested in what Powell will say. Otherwise, it's true that there's a lot of red this week and it doesn't look good in the portfolio, but at least I bought a little something.

Nvidia is strengthening its dominance in the chip markets.

Today I read a new report that Nvidia $NVDA and AMD $AMD are working on Arm-based PC chips. These Arm-based chips, also used for smartphones, often consume significantly less power, which is critical for battery-powered devices.

Read more

Zobrazit další komentáře

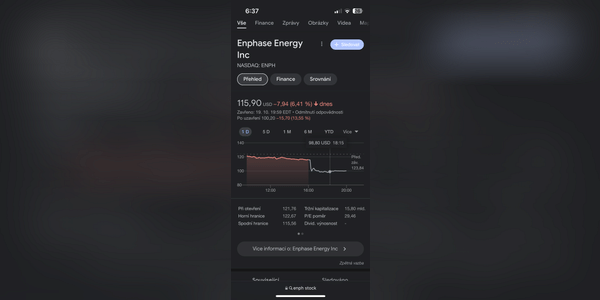

I entered at $115 - not a very high amount as I expected to see at least $110 due to rates. So I guess it will be even less. 25 times earnings is absolutely beautiful for me in this segment. I'm scared of those earnings, but I'll sit tight completely and hopefully it will show in a few years.

Have a nice ending Sunday and a successful start to another week full of results. 🍀💰

News from Saturday, 10/14/23 that jumped out at me and again around the Fed.

As we know, the Fed is scheduled to meet on 10/31-1/11. Originally it looked pretty realistic that another interest rate hike was coming. In the end, according to Bloomberg, the Fed is going to extend the pause. So now...

Read more

Tomorrow's inflation data, CPI in the US is coming up and I'm quite tense as it will pretty much show the Fed's direction.

We've had a stock market crash in recent weeks. But as we get closer to an important date, we've seen a reversal and gains the last few days. There is also news that marks a drop in the percentage of possible interest rate hikes, which as recently as last...

Read more

After a long time we finally started the week green. 🍀🚀

I'll take the liberty of doing a little recap, because we have a lot to look forward to in the coming days and weeks. 😊 I won't write too much about Saturday's attack on Izreal and the declaration of martial law. The internet is full of it. Discussion, what impact could this have on stocks? ...also here is a nice article on...

Read more

Investors, I am interested in your opinion on the Czech Stock Exchange. 🇨🇿

I know that occasionally there are opinions on some titles here, mostly the well-known ones like CEZ, KB, Moneta, and a few times there was a question about Kofola (besides, I recently got a message that its CEO was buying shares at the beginning of the summer).

I'm not personally in this market, but I've...

Read more

So another week ends with another decline.

Today we expect data from the US labour market. The result, unfortunately negative, exceeded by up to twice the expectations of economists who had estimated the creation of 170 000 jobs. However, the data pointed to a figure of up to 330 thousand jobs. 🤔

What this shows - that the resilience of the labor market may further pressure the...

Read more

So today we have another "washout" in the markets. 🤔

This time I don't want to add some news to a certain company, as I usually do, because we have times now when almost everything is dropping. I think we are seeing a similar picture to what we saw last fall, 2022.

I want to elaborate on two views:

1, Around what price levels do you expect the declines to stop? (Estimate approx,...

Read more

Shares of Nike $NKE jumped after it beat earnings estimates and cut the stock.

I noticed this week that quite a few people were waiting for this company's results. I personally follow it as well, I like its products and was still waiting though for a possible pullback. So let's get to the results.

Read more

Zobrazit další komentáře

Great, I didn't even get a chance to look at the results, so thanks for the summary. I don't have NKE shares, however I would like to include them in my portfolio, but the stock is still expensive at the moment.

Zobrazit další komentáře

So maybe there will be a correction