With the economic situation we have here and in the U.S. market today, what do you see as a better investment? Is it more dividend, value and long-term stable stocks, or is it more worth investing in riskier, growth titles with a vision for the future right now? Thanks for your opinions. :)

Barrett Gardener

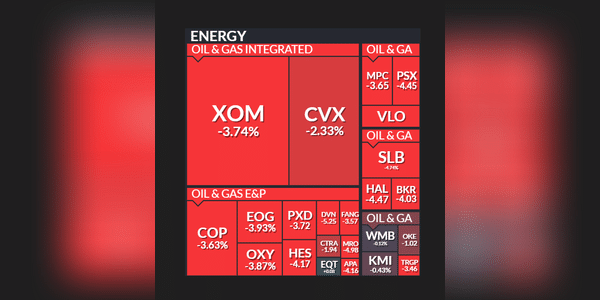

The energy sector has had a decent washout today, do you have any favorites that you will be buying after these declines?

Zobrazit další komentáře

I've been thinking about buying $AMZN stock for a long time, but I'll wait a while for a better price.

Investors, how do you see the next development of the USD/EUR currency pair? I don't understand the behaviour of currencies enough myself to have a good idea of what will happen.

How do you see this currency pair in the short-long term, will the USD strengthen? :)

Zobrazit další komentáře

I know about this company, but I haven't thought of it as an investment. The chart looks nice and I will probably take a closer look at this company. Thanks for the tip :)

Evergrande Group and its shares continue to fall on fears of a possible collapse of the company.

Evergrade, which has become a symbol of China's real estate problem, continues to fall 19% to 32 Hong Kong cents (4 U.S. cents), which has reduced the company's market capitalization to just HK$4.2 billion (US$539 million). Evergrande has lost 99.9% of its value since its peak in...

Read more

Zobrazit další komentáře

That chart is really crazy. This doesn't look like a healthy company from the looks of it anymore...The price per share is under $0.5, but 6 years ago it was $32.

Palantir $PLTR has been awarded a $250 million contract by the U.S. Army for artificial intelligence research. This is proof that the government sector is still a lucrative business for the company and that Palantir is a key player. While Palantir is not a content creator using AI, it instead excels at organizing and leveraging that data. And in response to this news, it now...

Read more

The S&P 493 index, the S&P 500 index excluding the 7 largest technology stocks, is up just 4% this year. $SPY

While the S&P 7, also known as the 7 largest companies in the S&P 500, rose 52%.

Taken together, the S&P 500 index as a whole is up 13% this year.

The seven largest stocks in the S&P 500 now account for a whopping 34% of the value of the entire index.

Without these 7 stocks...

Read more

Zobrazit další komentáře

Judging by $META' s latest event, the AI hype is far from over, it's about time.

Zobrazit další komentáře

I don't have any stocks from this sector in my portfolio yet, but I really like $CVX.

How do you feel about investing in gold?

Do any of you here invest in gold, other commodities or, for example, companies that are closely linked to gold and the gold price? I'm thinking of companies like $RGLD $DRD etc.

I'd be very interested to hear your views on this sector, as I'm not that familiar with the investment sector myself, and I'd love to hear your thoughts on...

Read more

Zobrazit další komentáře

I've only traded $GLD ETF options so far, otherwise it makes more sense to me to send a smaller amount per month into real gold and then keep it at home.

How do you see Alibaba $BABA nowadays? I like the company a lot, but there is still one big negative and that is the Chinese market. That is the main issue that is keeping me from buying this company.

How do you see it? Can the company look back to its highs and make sense at today's prices?

Zobrazit další komentáře

I would like to include this company's shares in my portfolio, but the Chinese market bothers me.

Zobrazit další komentáře

It's probably an interesting company, but I don't have shares of this company in my portfolio and probably don't want to.

The markets are showing us a strong sell-off to end the week with big losses in the major stock indices, with the US 500 index down nearly 3% and the Nasdaq 100 down 3.6% in just the last two days! These declines could reveal some nice buying opportunities again next week.

What stock titles are you currently eyeing and planning to buy? Inspiration for your weekend analysis. :-)...

Read more

Investors, have you ever fallen for FOMU yourself? "Fear of missing out. What investment was it and what caused it? :)

Personally, I felt the most FOMO on myself during the last BTC bullrun when I bought $BTCUSD for $53000. Fortunately it wasn't for a particularly high amount and in retrospect I think it gave me more than it took. Since then, FOMO has completely let me go and I...

Read more

Zobrazit další komentáře

Sometimes? I fail every day when I come here and find out where I missed it.. realistically FOMO is the only mental problem I have with investing

I try to make my portfolio mainly value stocks, but I do have some growth stocks in my portfolio.