Lately, I've been running into companies I didn't even know had publicly traded stocks like $WISH, $GPRO or $DUOL. $WISH and $GPRO have a very similar chart, the stock shot up in the beginning, but then quickly fell again and hasn't risen since. But I quite like $DUOL as I see potential here and I think people will use this app even more and so their stock could go up. I...

Read more

Bill Combs

Pfizer $PFE reported results today. You could say that the results beat expectations, but the revenue just missed expectations. Revenue was down from Q1 this year as sales of the Covid-19 vaccine fell 83% and revenue from the Paxlovide antiviral treatment fell 98%.

I've been buying $PFE shares recently as they are currently at a really low price.

Investors, which company's results surprised you the most this week and which company's results are you looking forward to next week?

I was certainly pleased with $GOOGL's results and surprised by $MMM's results as I was expecting much worse given the situation they are currently in. As for next week, I'm looking forward to and interested in the results of $PFE, $CVS, $SBUX, $AM...

Read more

I've been looking at Stryker for a while now, and I quite like the company. This company specializes in the manufacture and distribution of medical equipment and technology, particularly in the areas of orthopedics, surgical technology, and neurology. This company focuses on important things and operates in an important sector, plus it is financially stable. I would like to...

Read more

Investors, what are your favorite books on investing and finance?

For me, Intelligent Investor or The Psychology of Money are great. I'm currently reading Rich Dad, Poor Dad and I'm about to start reading The Richest Man in Babylon.

Zobrazit další komentáře

The books you mention are awesome classic titles that every investor should know, they even had some great sales on books right now, so I bought 10 books under 100kc on finance there, so I'll be busy :D

Zobrazit další komentáře

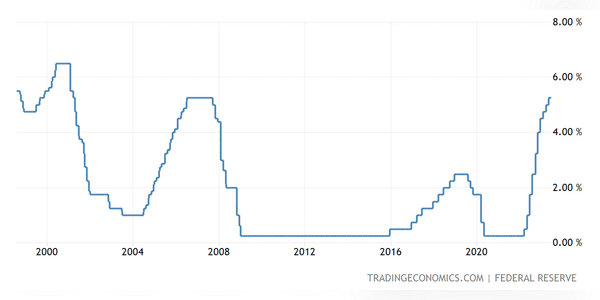

I'm expecting 25bps so hopefully we won't be unhappily surprised if they announce the latest rate hike I wouldn't be angry at all.

On Friday, Procter & Gamble reports its results. This company is in the drugstore business and makes many well-known products. Overall, $PG is a nice value stock and the company is financially stable. Plus, people will need drugstore goods all the time. Currently, it seems to me that $PG stock is high. I would like to include their stock in my portfolio, however the stock would...

Read more

Next week we will report the results of several interesting and well-known companies such as $GOOGL, $MSFT, or $PG. I'm definitely interested in the results of $GOOGL, $PG, $MCD, and I'm also interested in the results of $MMM because of where they are. Of course, I look forward to seeing the results of the other companies as well.

What companies' results will you be watching...

Read more

Zobrazit další komentáře

Investors, the pharmaceutical company Johnson & Johnson reported results today and the results beat expectations. Overall, I see potential in pharmaceutical and medical device companies and I like to invest in them. I already have $CVS in my portfolio and plan to add $PFE to my portfolio. I would like to add $JNJ to my portfolio, but it is at a high price and I fear it will be...

Read more

Zobrazit další komentáře

I would like to include in my portfolio the shares of at least one agricultural company. Recently mentioned here was $DE stock which I quite like. However, I have come across one other company, and that is Archer Daniels Midlan. This American company is involved in the processing of food and agricultural raw materials.

...Read more

Tomorrow, many interesting and well-known companies will report their results, but I will be most interested in the results of the Dutch company $ASML. This company produces advanced equipment for chip manufacturing. ASML is very financially stable. In addition, I would like to buy shares of a European company already. However, the stock is really high at the moment.

...Read more

Zobrazit další komentáře

Before someone writes again that it's very expensive, I hope he doesn't plan to buy MSFT, AAPL, KO, PEP and similar evergreens in the near future;)

Take a look at your portfolio and see how many stocks you hold have a PEG ratio lower than 1.68

ASML has been growing 25% for the last 5 years and the forecast for the next 5 years is the same, except that analysts know exactly what earnings they will have 2 years in advance because that is how long they wait for orders to clear.

btw the fact that it is worth 800usd today solves the fractional shares, who expects this company to drop to a P/E of 25 so will wait another 5 years;)

Zobrazit další komentáře

Duolingo's numbers don't look good. I avoid it, although I like the app.