Health insurer stock prices fell today after UnitedHealth($UNH) said the number of surgeries for adults age 65 and older increased more than expected over the past two months.

Health insurers have benefited from delaying non-urgent surgeries due to the COVID-19 pandemic and staffing shortages at hospitals.

For example, the popular $CVS here fell less than 6%. An opportunity to...

Read more

Rickie Reeve

Beware!

Why do the research when someone else can do it better for you?

Berkshire Hathaway has been buying large quantities of $OXY for almost a year at a price of around $60. Despite these purchases, the stock price hasn't moved anywhere and is at similar levels.

Such purchases indicate to me that Berkshire has confidence in Occidental Petroleum, so why shouldn't I?

Warren Buffett...

Read more

Zobrazit další komentáře

Well, I'll admit I was the poster child in the Buffett lover's world, watching the portfolio and including it in mine. But I'm not buying anymore, I agree that companies are not doing much, it's still going sideways and there are a lot of commodity companies on the market. I'm not saying it's bad, but really not much so far.

Most of you have probably registered the Bud Light $BUD scandal.

Since that scandal, the company's sales have plummeted, but despite that, Bud Light has remained the best-selling beer in the US.

The lower sales have, of course, had an impact on the share price, which has dropped by more than 15% since the event.

Read more

Zobrazit další komentáře

Up 8% on capital gains in 20 years. You want that. 🙈 Long term margins are down, but otherwise financially fine. Except for the fluctuating dividend. 😔

Have you bought shares in a company in an IPO?

It is quite common for the share price to rise immediately after an IPO. I have heard the opinion that it may not be a bad idea to take advantage of this with a bracket order. I am wondering if anyone has experience with this.

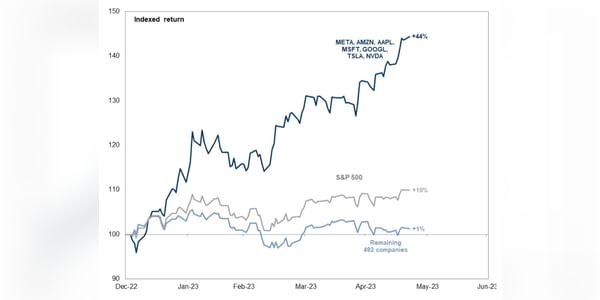

I'm also attaching an interesting figure (note, it's as of 3/13/2023) that compares the market...

Read more

Zobrazit další komentáře

I am already watching the IPO today and I am also waiting. I won't lie though and yes I also got burned when I started investing and didn't have that information, experience yet, I took the IPO as an advantage, it's new, it will grow, well and yes it's not most of the time. (sometimes maybe it is) ... on Coinbase I also got burned, I got a purchase for 86$.🤦♂️ I'm holding on though, I guess I got used to the slump and other titles kind of wiped it out. But I believe that if they can withstand the courts and can function with increasing regulations, when BTC grows again, they will too.

Zobrazit další komentáře

I've looked into the stats more and they have debt that's been growing for a few years now doesn't that somehow discourage you? 😁 Sure it's a big company and it's been around for over 120 years or whatever but I somehow don't really like it when that debt approaches almost half the value of the company 🤔

I see a lot of investors focusing on small-cap companies. I'm sure many are unfairly overlooked and therefore undervalued. But then isn't the lack of available information a problem? After all, there is a lot of information about larger companies everywhere. I wonder the same thing about companies from "exotic" countries.

I would not like to invest purely on the basis of...

Read more

Zobrazit další komentáře

Sometimes I also grope as you say, I follow those well known foreign sites like yaho finance, cnbc, marketwatch, tradingview. But as you say, it's harder with small-cap and also in terms of broker. Sometimes even the broker doesn't have them listed.

The British economy has been through a difficult period since 2015

First there was uncertainty about the terms of the Brexit deal and its consequences, then came the Covid-19 pandemic, followed by wars in Europe, double-digit inflation and the currency crisis. That is almost 10 years of uncertainty that has led to low investor, business and consumer confidence.

This year, the...

Read more

Zobrazit další komentáře

Britain's economy is beginning to stabilise after a series of economic shocks, but what do we make of a brighter tomorrow? 😄 Investment-wise, there's nothing really appealing to me.

Zobrazit další komentáře

So I'll join in too, I didn't know about it :D actually I like it a lot and I'll definitely add it to my portfolio.... Just a shame I didn't find out more about her the purchase at 44 approx was pretty luxurious who bought... If I were to buy a bigger position, 44-48usd hopefully I'll see.. :D

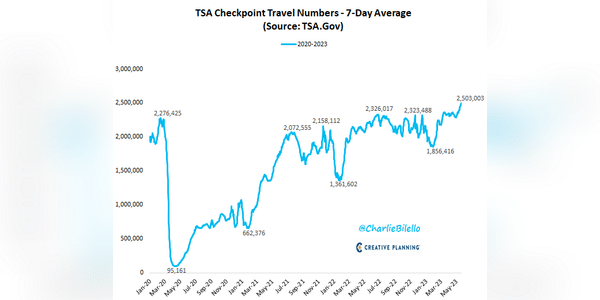

Travel recovers in the United States after covid slump

On average, more than 2.5 million passengers traveled on U.S. airlines daily last week, the most since August 2019.

I myself was under the mistaken impression that travel had still not returned to pre-Covid levels. Even the situation in Europe is slowly approaching 2019.

Yet airline stocks are still low.($LUV, $AAL)

Read more

Zobrazit další komentáře

Amazon $AMZN in talks to offer free mobile service to Prime subscribers in the U.S.

This news immediately negatively impacted telecom stocks such as $TMUS, $VZ and $T.

According to YahooFinance, Amazon has been talking to wireless carriers about offering low-cost, or possibly free, nationwide mobile phone service to Prime subscribers. Negotiations have reportedly been ongoing for...

Read more

Zobrazit další komentáře

Great, thanks for the report. The news is great, however I would need some downside to buy the stock :)

A few hours ago, Mark Zuckerberg unveiled a new virtual reality headset called Meta Quest 3 on his Instagram.

In terms of performance, it should be a decent step up - especially graphically. However, we'll find out more at the conference on September 27.

The price will be $500.

Read more

$SOFI is growing again in the premarket. 🟢

Could the tables have turned and SoFi stock has finally started to rise? For a long time, despite a lot of great news, SoFi has been falling in price. Many have even talked about manipulating the price of this stock.

I like to see these moves, but I don't put too much emphasis on them - SoFi is a long-term investment. I think it could be...

Read more

Zobrazit další komentáře

I already have an appreciation of +50%, I don't know whether to take profit. I've been buying at levels as we speak. I definitely trust Sofi and for me a super company in the future.

Zobrazit další komentáře

I don't like the stagnant cloud there at all. If they want to do an IPO they should do something about it;)

Good thing it's the S&P500 and not the S&P493. 😁

Nice, I'll probably jump into $CVS:)